You can’t set up projects and assign them to team members—meaning you can’t also track actual income and expenses by projects. You can only create customized estimates and send them to new or prospective customers. Wave Invoicing is ideal for freelancers, entrepreneurs or small businesses. The fact that it is free makes it a great option for those just starting out or those who want to keep their overhead a beginner’s guide to operating expenses for small businesses as low as possible. Companies that want to combine project management tasks in their accounting software or are looking for software with a great mobile app that they can use on the go will probably want to look for other options. Users can connect an unlimited number of bank accounts to Wave Accounting software, ensuring every transaction is accounted for and financial snapshots are up to date.

Expense Tracking

- Until recently, Wave was best-known for its completely free accounting solution.

- In contrast, FreshBooks’ cheapest plan starts at $19 and limits you to billing just five clients a month.

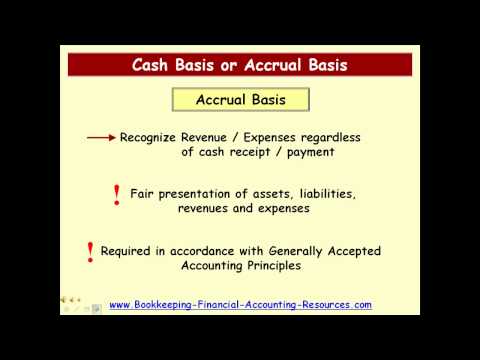

- Wave Accounting also uses double-entry accounting, which is much more accurate than basic single-entry accounting.

- Get more information about how it stacks up with our Wave Payroll review.

- The software has a clean and user-friendly interface that makes navigation simple.

QuickBooks Online limits user numbers by plan (its cheapest plan, QuickBooks Simple Start, includes just three users). And FreshBooks doesn’t limit your user number, but it does charge an extra $10 a month per user—which adds up fast. Wave accounting integrates with bank accounts, and can accept credit card payments as well as online bank transfers to your business. You can also manage paying outside contractors, and send and manage receipts. That’s not the case with Wave—it provides one plan with an unlimited number of users, invoices, credit card connections and reports for free.

G2Crowd 4.4 out of 5 (264 reviews)

Allows an unlimited number of users in the Pro plan, but is not complex enough for businesses with more than a handful of employees; ideal for very small service-based businesses, freelancers or contractors. We believe everyone should be able to make financial decisions with confidence. Your team of financial professionals will need to be able to access https://www.personal-accounting.org/accounting-for-startups-7-bookkeeping-tips-for/ your books easily and with minimal risk of error. Check with your bookkeeper or accountant before choosing software. While accountants typically work with paid products like QuickBooks Online or Xero, they may be familiar with some of the free ones listed here, too. Odoo is an ecosystem of business software that promises to integrate seamlessly.

Income and expense tracking

This influences which products we write about and where and how the product appears on a page. GnuCash is appealing for its fully free software and benefits that come with open-source technology, like faster iteration and improvement due to its crowdsourced development and testing. However, GnuCash will also require some familiarity with coding as well as some comfort with using a checkbook-style register and entering transactions manually. Among other capabilities, you can split transactions and customize how the register is displayed. Consider it if you’re a startup retail business on a budget with the need to carefully track and manage inventory.

You can invite your accountants, bookkeepers or other business partners to Wave via email and designate their user roles. They can receive “editor permissions” and access accounting and reports as well as purchases easily. Xero lets you add unlimited users in all plan tiers and, similar to QuickBooks Online, can grow alongside your business. QuickBooks Online’s detailed reporting and transaction tracking is ideal for growing businesses. FreshBooks is an affordable option for freelancers and small service-based businesses that operate mostly on the go. Many or all of the products featured here are from our partners who compensate us.

Wave accounting overview: what is Wave accounting & what is the Wave accounting system used for?

The drawback of just offering one plan is that it limits room for growth. While other software solutions have a premium plan that provides advanced features for growing businesses, Wave does not provide more advanced accounting plan options outside of its one free plan. Whether you are struggling with sending out invoices on time, keeping track of payments or organizing tax information, Wave helps business owners get a handle on their accounting department at no monthly cost.

The market is stacked with competitive accounting software options though, so check out our comparison page to see how the best of the best compare side by side. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. With plans starting https://www.business-accounting.net/ at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike. Enter some basic information about your business’s accounting software needs and we’ll send you up to five personalized quotes for absolutely free. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

You can also visit Wave’s Help Center to browse through a variety of application categories, ask a question, or access one of the Wave Guides. We use dedicated people and clever technology to safeguard our platform. Labeled Verified, they’re about genuine experiences.Learn more about other kinds of reviews. We did the research, and it seems there are no Wave accounting coupon codes or discount vouchers at this time. To learn more about how we rate and review our software, including how we calculate star ratings for each brand we review, read our software review methodology overview. Open-source model encourages regular testing and improvement of the software.

Pricing is transparent, there are a decent number of add-ons, and even the paid plan is pretty affordable. These factors contributed to our rating of 4.4/5 for Wave’s pricing and fees. This free, easy-to-use accounting software is great for small businesses, especially for eCommerce, but lacks in project management, budgeting, and inventory tracking. Make it easier for your customers to pay you through a Wave invoice, right from their bank accounts.

If you want professional help to get your business up and running, you can access bookkeeping experts through Wave for $149 per month. If you want more in-depth support, accountants and payroll coaches are available starting at $379 per month. Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags. Our partners cannot pay us to guarantee favorable reviews of their products or services. Consider it if you run your own business and don’t pay employees.